More than 800 of 1,000 Filipinos are now showing keen interest in the usage of artificial intelligence (AI) in preventing fraud transactions in banking, a study from Visa revealed.

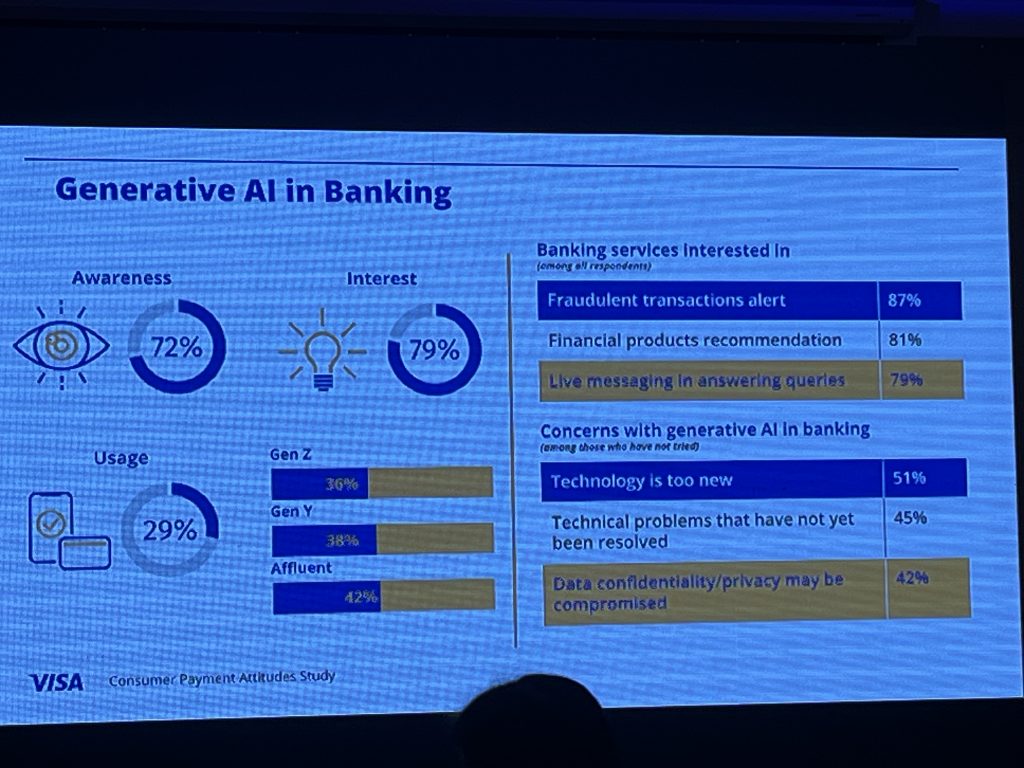

According to the latest Visa Consumer Payment Attitudes Study, 87% of the Filipinos surveyed by Visa are interested in AI-powered security measures, while 79% are generally interested in the use of AI in banking.

The survey results also showed their interest in using AI in financial product recommendations (81%) and live messaging regarding needs and queries (79%).

However, In reality, only 29% are actually using AI in banking, which is driven by the younger population.

This is attributed to the concerns raised by the respondents, which led by the consumers’ perception of AI being a new technology, followed by technical problems that have not been resolved, and data confidentiality concerns.

Jeff Navarro, Visa’s country manager for the Philippines, believe that there has to be more communication regarding these issues raised by the respondents.

“So if these things can be addressed, then we feel that the interest level of 79 can actually increase the usage,” the country manager said.

Moreover, Navarro also revealed that Visa has been investing more in AI, as it has seen its value in determining patterns when it comes to fraud detection.

“We’re also investing a hundred million dollars in future companies and startups that will really go into the area of AI that will also touch on cybersecurity,” he said.

Visa recently released a new product called the Visa RTP PreventService, which is an AI-powered network agnostic solution.

It analyzes information in a transaction, real-time, and provides a risk assessment to the financial institution involved. This will help the bank in deciding whether to authorize the transaction, which can help catch fraudsters.

Moreover, Navarro said they have been partnering with other financial institutions and regulators to address the education problem in digital banking against scams.

Visa’s annual study was conducted from October to November 2023 to understand consumer behaviors, market appetite, perception and utilization of digital payment.